What is NPS

NPS is referred as National Pension Scheme. In this scheme, one can contribute to a pension fund (it is just like a mutual fund, rather a mutual fund with certain rules set by the govt). You have to invest in NPS till your retirement (age 60) and the final corpus will depend on how the pension fund has performed over the years.

At retirement (60 yrs), you can withdraw part of the corpus as a lump sum (max 60% of corpus) and the balance will be used to provide you a regular pension till your death (called annuity plan). Anyone can invest in NPS including NRIs. (Age at entry 18 to 65).

NPS is regulated by PFRDA – Pension Fund Regulatory & Development Authority. The money invested in NPS is managed by Pension Fund Managers (PFM). These are companies that are authorized and appointment by PFRDA to manage the wealth of investors.

There are eight PFM as on date (2022): –

- Kotak Mahindra Pension Fund

- LIC Pension Fund

- ICICI Prudential Pension Fund

- Reliance Capital Pension Fund

- Birla Pension Fund

- UTI Retirement Solutions Pension Fund

- HDFC Pension Management Company

- SBI Pension Fund

What are the types of Funds in NPS?

In NPS there are four asset classes :-

- E – Equity (High Risk – High Returns)

- C – Corporate Bonds (Moderate Risk – Moderate Returns)

- G – Government Bonds (Low Risk – Low Returns)

- A – Alternative assets like real estate investment trust (REITs) & infrastructural investment trusts (InvIT) (Very High Risk – Moderate Returns)

The choice of asset allocation among these options above will be defined by the investor himself (Active mode) or it will be auto defined (Auto mode) depending on the age of the subscriber (the older you get, more stable will be your investments). In both options, 75% is the maximum limit for investing in equities and for alternative assets class maximum contribution can be 5%.

Active mode in NPS

This choice is for NPS subscribers who wish to decide the asset class allocation on their own. In the NPS Active Choice, subscribers have the option to choose the ratio in which their contributions will be invested among various asset classes or the NPS funds that offer a defined combination. That is, you get a say in your asset allocation. However, there are limitations even within this choice as the maximum permitted allocation to equities is restricted to 75%. The active fund allows you to maintain 75% equity exposure till you turn 50. But as soon as the subscriber turns 50, the equity portion starts to taper off by 2.5% each year till it reaches 50% by the age of 60 years. This is according to a fixed schedule as set by PFRDA for NPS Active Choice. The rationale for such a move by the PFRDA is to reduce the impact of volatility with equity investments as the subscriber approaches retirement.

Auto mode in NPS

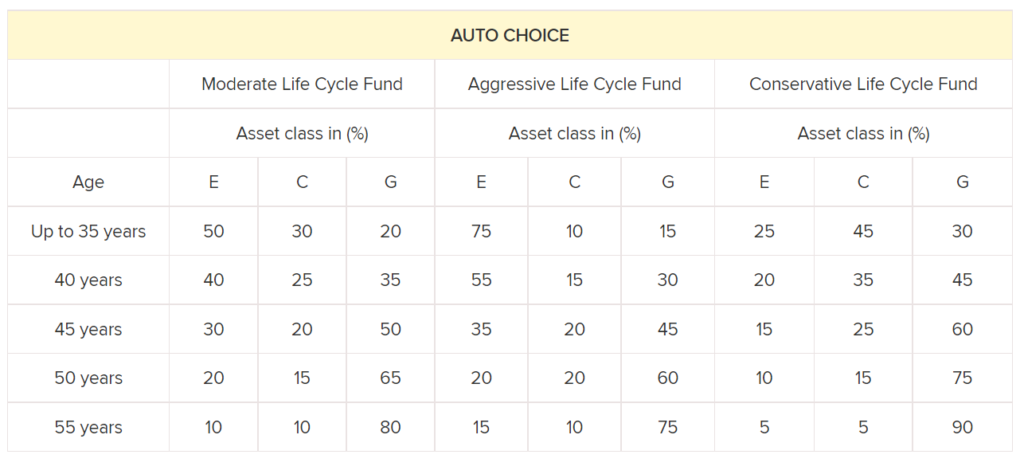

The NPS Auto Choice option works well for passive investors and those who seek to let an automatic allocation decide the proportion of money spread across the available asset classes. This allocation adopts a life-cycle based approach and starts with an equity-heavy portfolio during the subscriber’s younger age and systematically reduces the equity exposure as the subscriber approaches retirement. A life-cycle based approach not only optimises returns but also cushions you from market volatility as you approach maturity.

Under the auto choice, the investments are made in a life-cycle fund with three life cycle funds (LC) to choose from:

1) Moderate Life Cycle Fund: It is the default option which caps the equity exposure to maximum of 50%.

2) Conservative Life Cycle Fund: As the name suggests, it takes a conservative approach to investing with maximum equity allocation capped at 25%

3) Aggressive Life cycle Fund: In this option, maximum equity allocation can go up to 75%.

What is Tier I and Tier II in NPS?

Tier I is “Pension account” whereas Tier II is an optional account commonly referred to as “Investment account”. You get the additional tax rebate of 50k in Tier I and it has some restrictions whereas Tier II is just like a normal mutual fund without the restrictions in Tier I.

Tax benefits of NPS?

In Tier I you can save up to 1.5 lakhs under 80C and an additional 50 k under 80 CCD. Tier II allows only central govt employees to save up to 1.5 lakh under 80C but this will have lock in of 3 years.

NPS rules for withdrawal Tier I

Once an investor retires at 60 yrs, they have 3 options

Option #1 – Exit from NPS at 60: If you want to exit from NPS at 60, you will get in lump-sum, 60% of your corpus and for remaining 40% an annuity will be generated with a PFRDA-registered insurance company (called as Annuity Service Providers) to provide monthly pension after your retirement. There are different annuity plans provided by a few insurance companies, you can choose any of them. And you also have the choice of increasing your annuity contribution (min 40% is mandatory). However, if the total corpus is 2 lakhs or less than it then the whole amount is given a lump sum.

Option #2 – Continue NPS with contribution till 70 yrs: You can choose to continue contributing to NPS for 10 more years i.e., till 70 years. At the age of 70 withdrawal rules will be the same as the exit from NPS at 60. On a serious note, why will someone choose this? When will you live your life?

Option #3 – Continue NPS with till 70 yrs, but without any further contribution: You can choose to not contribute to NPS and wait for your corpus to grow for another 10 years. Thereafter at the age of 70 withdrawal rules will be the same as an exit from NPS at 60. This option has to be exercised 15 days before the default date of withdrawal.

Note: Subscriber has to exercise continuation or deferment options 15 days before the date of retirement. Lump-sum withdrawal from NPS is tax-free. Whereas monthly pension will be taxable as per the tax slab of the subscriber.

Withdrawals in Tier II?

There is no limit on tier II withdrawals and all the withdrawals are taxable and taxation is similar to MFs. It means Tier II works in the same way as Mutual Funds and has high Liquidity.

What if I want to early withdraw i.e., before 60 years of age?

NPS is for retirement savings and you should not exit before the age of 60. However, in some special cases, you can withdraw 25% in total of your own contribution in NPS. This you can do only after 3 years of investment and just 3 times in the entire tenure of NPS. The special cases are –

– Children’s wedding or higher studies

– Building/buying a house

– Critical illness of self/family

Note: Partial withdrawal from NPS is tax-free.

What if I want to exit from NPS before 60 years of age?

After 3 years of NPS investment, you can opt for a premature exit from NPS if you do not want to contribute anymore. In this case you will receive 20% of your corpus as a lump sum and balance 80% will be mandatorily used for annuity fund. You can choose pension payment mode like monthly, half-yearly or yearly. This is not a good option to exercise.

Note: In this case, the lump sum and pension you receive both will be taxable as per income tax slap.

What is annuity plan in NPS?

At age 60 or thereafter when you withdraw the lumpsum corpus, the remaining balance of 40% goes into an annuity plan which is provided by a registered insurance company. In this plan certain returns are obtained and you will get paid a monthly pension out of this. The monthly pension amount will depend upon the annuity plan that you choose, the corpus that goes into annuity and the interest rates at the time. The larger the corpus/interest rates, the higher will be the pension.

What are the types of annuity plans?

There are different plans being provided by different ASPs. Here are some of the common plans: –

ROP – ROP means return of purchase price

· Annuity for Life with ROP – Subscriber will get annuity for life time and on death of the Subscriber, payment of annuity ceases & 100% of the purchase price will be returned to the nominee(s)

· Joint Life Annuity with ROP – Subscriber will get annuity for life time and on death of the Subscriber, annuity will be payable to Spouse for life time. On death of the Spouse, payment of annuity ceases and 100% of the purchase price will be returned to the nominee(s).

· NPS – Family Income with ROP – Subscriber will get annuity for life time and on death of the Subscriber, annuity will be payable to spouse of the Subscriber (if any) for life time. On death of Spouse, to dependent mother and then to dependent father of the Subscriber. On death of the last annuitant, payment of annuity ceases and 100% of the purchase price will be returned to the surviving children of the Subscriber / to legal heirs as applicable.

· Annuity for Life without ROP – Subscriber will get annuity for life time and on death of the Subscriber, payment of annuity ceases and no further amount will be payable.

· Joint Life Annuity without ROP – Subscriber will get annuity for life time and on death of the Subscriber, annuity will be payable to Spouse for life time. On death of the Spouse, payment of annuity ceases and no further amount will be payable.

You can go to NPS website from link below to generate an annuity quote: –

Click Here…

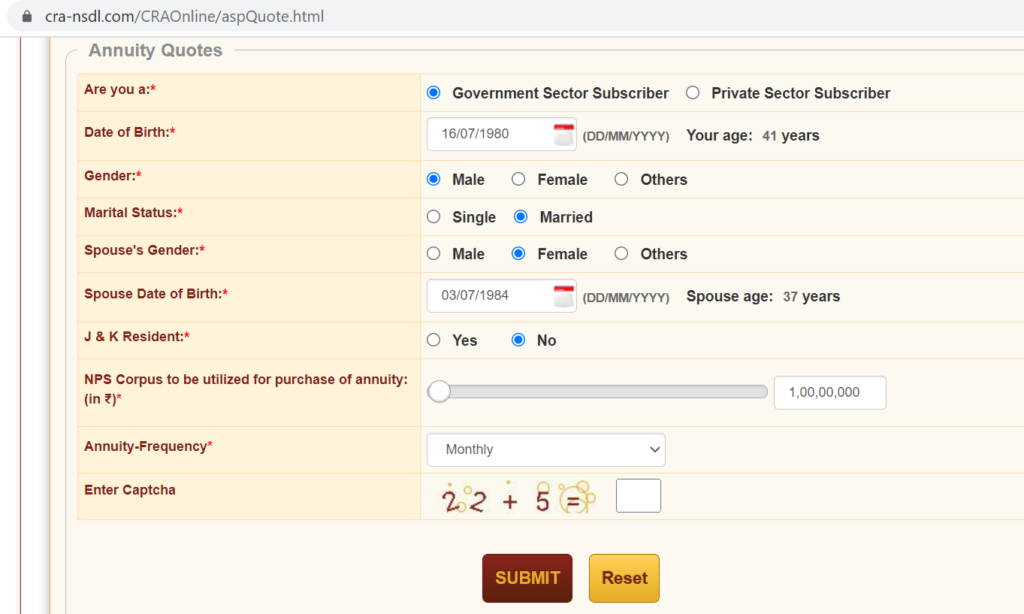

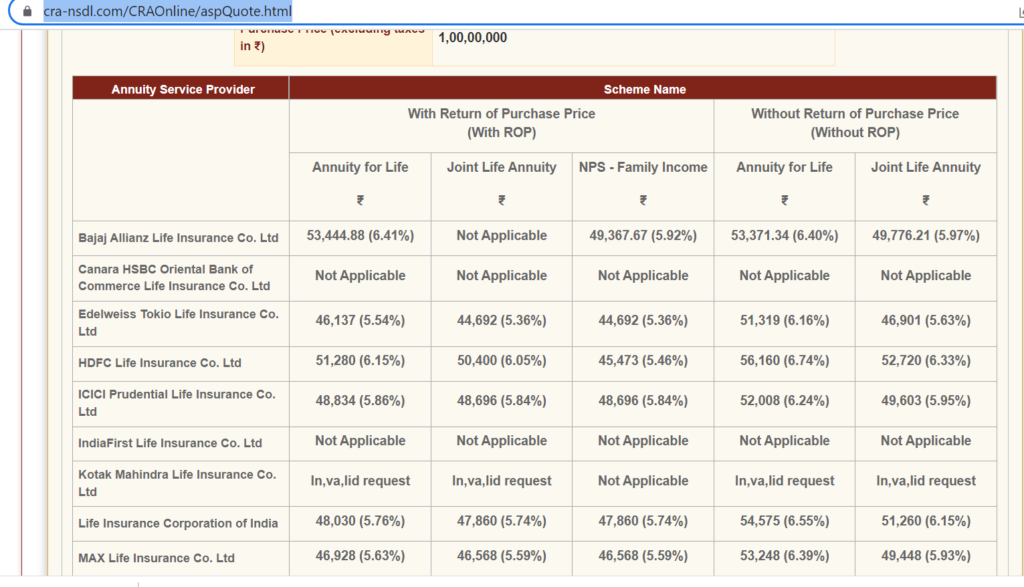

Sample annuity quote as on 2022

The annuity amounts shown below are as taken on day and may differ from the value at time of purchase of the annuity due to changes in premium rates by the annuity service providers during the period.

Data used to generate annuity pension for 1 crore corpus that goes into annuity plan

Likely pension from the above data (as on 2022)

What returns can one expect in the annuity plan?

As NPS is a new scheme, it is not very clear as to what returns will be provided in the annuity plan but usually in such plans the returns are low. Not more than 6-8% can be expected in present scenario.

Who are the Annuity Service Providers?

Following are the PFRDA registered Annuity service providers: –

- Life Insurance Corporation of India (LIC)

- SBI Life Insurance

- ICICI Prudential Life Insurance

- Bajaj Allianz Life Insurance

- Star Union Dai-ichi Life Insurance

- Reliance Life Insurance

- HDFC Standard Life Insurance

Advantages of NPS: –

– Good pension scheme– Not everyone will get a pension by their employers. It is mostly limited to govt employees. NPS is a good way to save towards retirement for those who will not get a pension. You will get a corpus at age 60 when you are likely to stop working and settle down at a place. You can use the corpus for buying a house, for children’s marriage expenses or park it an avenue from where you can use it as you require. The monthly pension that you will get thereafter will take care of your household expenses.

– NPS ensures financial discipline– NPS is good for people with poor financial discipline as it has lock in till 60 yrs of age. NPS will ensure discipline in savings as it is not easy to withdraw from NPS. Whereas the performance of mutual funds is very similar or better than NPS but since it does not have restrictions on withdrawal which works against many. Often people invest in MF but most are never able to generate wealth through it because they take irrational decisions due market ups and downs and eventually quit never to come back again. These people blame market thereafter whereas the limitation lies in them. Many investors use MFs as bank account and withdraw from time to time due to which they are never able to build a sizeable corpus. Since NPS is for retirement savings and withdrawals are restricted, people are likely to put money in it and forget it which will generate returns for them in long run.

–Good returns– The returns of NPS are good compared to PPF and other traditional avenues. Other traditional avenues like PPF, FDs etc give much less returns whereas NPS invests in equities where the returns are likely to be in double digits (in equity class). Equities work very well in the long duration and if you put at least 10% of your monthly salary in it, it is likely to build a sizeable corpus for you when you turn 60(provided you start at the earliest).

– Tax free returns– The 60% amount that one can withdraw at 60 yrs of age is tax free.

Disadvantages of NPS: –

– Lock in till 60 yrs– NPS has lock in till 60 yrs and one can withdraw only 25% of the corpus before that for some important life needs. Whereas one may require a major portion of the corpus for major expenses like children’s higher education, building a house, children’s marriage etc or in case of any unforeseen requirement. Though this restriction is to keep one invested for the ultimate goal of pension but it is a limitation as well.

–Cannot withdraw the entire corpus at 60– You cannot withdraw the entire corpus at 60 and 40% mandatorily goes in annuity plan. The returns of annuity plans aren’t great and also the pension through this plan will get taxed at slab rates.

Our recommendation

NPS is definitely a very avenue to save for retirement. Unlike the traditional avenue it has equity exposure which will generate good returns in long run. The lock in till 60 yrs will ensure one stays invested despite the market ups and downs which will eventually generate good returns.

Who should invest in NPS– NPS is recommended only for those who are not likely to get a pension from their employer. For those who will get a pension, they may explore normal mutual funds which do not have the restrictions like NPS.

How much should one invest in NPS– Minimum 10% of the salary and not more than 20% of salary in any case as you cannot withdraw most of the corpus till 60. For the remaining savings you should consider other options which do not have the withdrawal restrictions.

Which mode of investment one should choose in NPS– Auto mode aggressive fund choice is the best for someone who really does not want to bother about getting into too much of technicalities of doing active management. Otherwise, active choice with 75% equity exposure and remaining in govt or corporate bonds is good if one has at least another 15 years till retirement age 60.

How should one invest in NPS- It is always advisable to setup up SIP type investment in NPS through auto debit.

By,

Sainik Wealth