Traditionally Insurances/endowment policies have been a very common investment option for many Indians. LIC policies were very common and continue to be for some people especially in small towns and rural areas. Is it really an investment? Does it really secure one’s life and help one achieve their financial goals like securing child’s future or retirement etc? At least they are marketed that way. Look at some of the ways they are marketed: –

Don’t these ads evoke emotions in you towards the dreams that you have for you and your family? And that is what they capitalise on. As you can see, the advertisements guarantee a secure future for your child, secure retirement, securing your dreams, tax free income. They advertise to provide life cover as well as a secure future. Let me tell you the life cover such policies provide will not suffice for most and yes definitely returns are guaranteed but they will be guaranteed poor returns.

Now there are such insurance policies from other companies like HDFC, ICICI, SBI etc and all are similar. There are mainly three types of Insurance policies: traditional insurance policies, ULIP’s (unit linked insurance plans) and Term Insurance policy. Term insurance is the insurance policy to go with. Traditional/endowment insurances are a total no no. ULIPs aren’t great but they are still far better than the traditional policies.

Traditional insurance plans mostly include endowment plans. An endowment plan is the worst Insurance that you could buy. You can expect a return of 4-6% in Endowment policies of LIC and other private companies.

Why are the returns poor in these policies?

LIC had monopoly till 1990s when private insurance companies were not allowed. IRDA (The Insurance Regulatory and Development Authority of India) governs Insurance companies. They are supposed to govern how of much of fees/commissions an Insurer can take. Since LIC had monopoly and it being a government company, all rules which were made favoured LIC. LIC was allowed huge margins on the investments of clients. It passes on a huge commission to the agents who distribute these policies. LIC does reciprocate to the govt by bailing out PSUs in grief, by buying their stocks when nobody else does. Yes so, they are doing a huge service to the nation, but at what cost? At the cost of poor returns to the policy holders? After private insurance came in late 1990 similar rules applied to them as the rules could not be different for govt players (LIC) and private players and they all make huge margin on these policies.

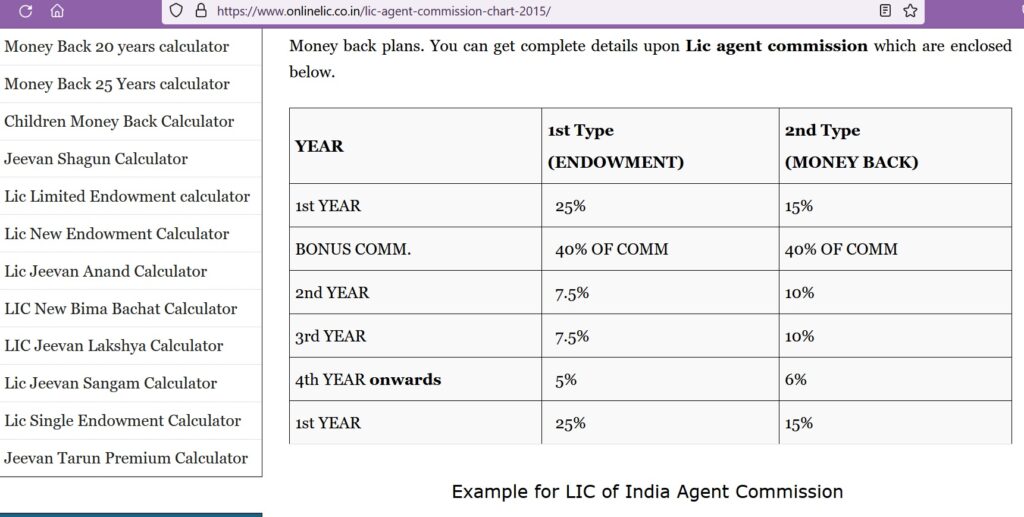

For traditional insurance policies an insurance company does not need to declare where it has invested the client’s money and how much returns it has earned and how much of fees is taken by the company. What you simply see is a bonus declared every year. You never come to know how much of your hard-earned money was taken as fees/commissions by the company. The life cover provided by Endowment plans is meagre. It could be say 5-10 times of premium paid in a year. Say you pay 1 lakh a year then you get a cover of 5 to 10 lakh which does not suffice for the family in case of an untoward event. If you want to calculate the returns of these policies, then use any compound interest calculator to calculate. All you will get out these policies is 4-6%. Back in those when interest rates were 12-13%, one could get up to 8% returns from these but that is not the case now. The endowment policies of private insurance companies have similar returns. Commissions to the agent could be 15-45% (in Endowment Plans especially LIC) of the amount paid in the first year. For the pvt companies the commissions are very similar. Say you pay 1 lakh in first year for a LIC/endowment policy of a company then the seller could get up to 15to 45 k of your money. For second and third year it reduces and 4th year onwards it usually 5% of what you pay that goes to the agent. So, if the agent is getting so much commissions out of your money than what returns can you expect? Don’t believe me. Checkout screenshot from the below link: –

LIC AGENT COMMISIONS (screenshot from above link)

You can read more from people personal experiences below in Quora: –

Click here for details

Those commissions were just what were going to the agent, remember the company also takes commissions out of your yearly payments. So, you are giving a major portion of your invested amount to the LIC/insurance agent and the company in first 3 years hence the poor returns.

How these traditional policies trap you even after you realise the poor returns?

One drawback of these policies is, if you decide to discontinue the policy in first 3 years you do not get back anything. If you discontinue after paying for 3 years, you get back about 30% of what you paid. If you discontinue after say like 8 years you just about get 80% of the amount paid, which is minus 20% returns. So actually, these policies trap you. Even if you find out a year later that the policy is not good and you want to discontinue it, you will not get back anything. So, people continue thinking they will lose what they have already paid, not realising they are continuing to put more money in an avenue which will give them poor returns. After starting the policy within 3-4 years if you realise the mistake that you made, it is still beneficial to discontinue the policy (even at the cost of losing what you already paid), invest the same amount in a better avenue. In the long run you will not only make up for the loss but even get better returns than what you could have by continuing this policy.

You actually lose money in these policies

If inflation is 5-7% then at 4-6% returns you are actually losing money in an endowment policy. So why is that people still buy LIC policies. Many people are not aware about these facts. They think that LIC is a govt company so the policy will be good for the people. Yes, off course it is good for people in terms that it generates employment, moves the economy but it’s not good for you unless you have a lot of money for charity.

Why people fall for such policies?

It is mostly due to marketing strategy used. Some of them give false verbal facts and figures to miss-sell. There is one Colonel, who was told that one such HDFC endowment policy has given 19% returns. He subscribed to 4 lakh per year of the insurance only to be guided by me later about the poor returns. Now he had two options either to continue in it or take the loss and get out. He opted out of paying further and lost the 4 lakhs.

When someone gives you such facts and figures, please ask them to show it in the company brochures and data from internet. Another reason why people buy such policies is because there is always some LIC agent in our families and we come under pressure to buy. You can read more on the internet.

Ask the insurance agent how much of his own money he has invested in the policy that he is offering you. Ask him to show you his policy.

Often bank employees will give you such policies because they have certain targets to meet. Not that they want bad for you but they are, they don’t have an option but to follow the targets that they are given and you become the target.

One more reason people fall for these policies is, they are told if you invest say 1 lakh per year for next 30 years then you will get 2 crores after 30 years. The figures may be right but you need to understand due inflation 2 crores will not have the same value as 2 crores today. It may be just equal to 30-40 lakhs as in today’s date. So, you have to do the actual numbers.

No information on fees and charges in endowment policies

If one has a look at the policy page of these insurances one will find that the fees and various charges of the policy are never mentioned or declared to the policy buyer. If you take ULIPS then all the charges and fees are clearly mentioned. Same in case of MFs where the fee is mentioned( TER- total expense ratio) but not in this case. LIC was the primary player in this field and it being a govt company, the rules were made this way otherwise who would buy these policies if one see such high commissions in first 3 years. The same rules applied to other pvt insurance companies later when they came in and they all take benefit of that. All they declare is some bonus from time to time and that’s another misleading info.

How to find out the returns of a policy being offered to you?

If you can’t do the math, simply Google – are Endowment policies good or go to YouTube and search for the returns of the plan the agent is selling you. You will find enough videos where people have calculated the actual returns and they are usually 4-6%.

If you go to a bank and say I want to invest, the first thing they usually offer is an Endowment Policy (try it out) and then may be ULIP, because it gives the seller maximum commissions.

Our recommendations

If you want life insurance go for term insurance policy. Keep your investments separate from life insurance requirements, if you don’t then you will get an insurance cover that wont suffice and an investment that will give you poor returns.

This video from YouTube will some up the poor returns of traditional insurance policies:

A different video on same topic:-

Please find the returns of one such policy- guaranteed income for tomorrow..

Sainik Wealth