So, the other day I met an officer who was going to retire soon and he told me he planned not to commute his pension as it will reduce his takeaway which may not be sufficient for monthly expenses. Then there was another NCO I met who said he was not planning to commute because if he commutes, he would get around 15 lakhs whereas if he doesn’t commute then in 15 years, he would get paid 15x12x15=27 lakhs approx(considering appx 1 lakh per 1k of pension commuted). So as per him he would get lesser amount if he commutes.

There are other articles on commutation of pension but in this article let us do the actual numbers and see as to why commutation of pension is always a better option.

The main reason for people to not commute is reduced monthly takeaway. When commuting one can use systematic withdrawal plan(SWP from debt mutual fund) from commuted corpus to draw a monthly amount which is the difference between uncommuted and commuted pension. This way the monthly take away will be same of non commuted pension. Here I am taking example a Colonel retiring at 55 yrs.

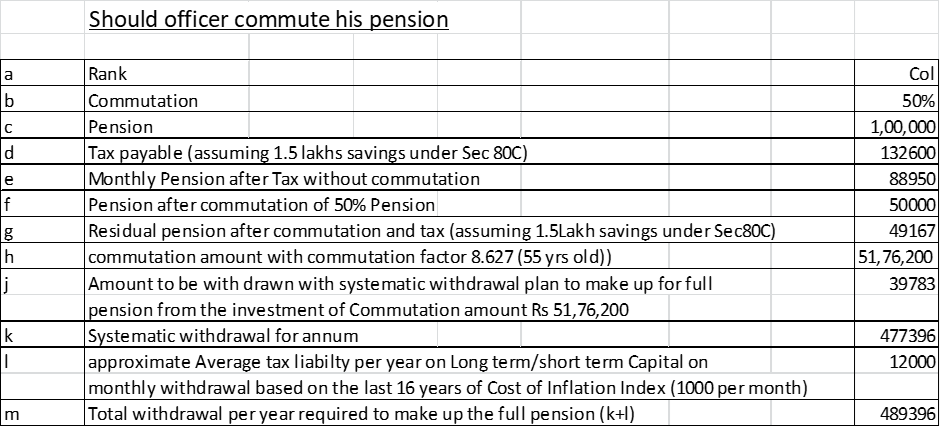

Let’s look at the actual numbers in the table below: –

Table 1

*DA not accounted.

The pension is fully taxable while the commuted amount is fully tax-free. If this commuted amount is properly invested, just a fraction of the tax would need to be paid(10% tax slab) compared to the tax on full un commuted pension(30% tax slab). Tax on full pension is Rs1,32,200/year( item d in table above), whereas tax on residual pension is Rs 10000/year and capital gains tax on mutual fund withdrawals is Rs12000(Totaling Rs22000).

So, from taxation perspective commutation is any day better.

Let’s dig deeper and understand things better: –

Returns Of Some Popular Govt/Bank Schemes

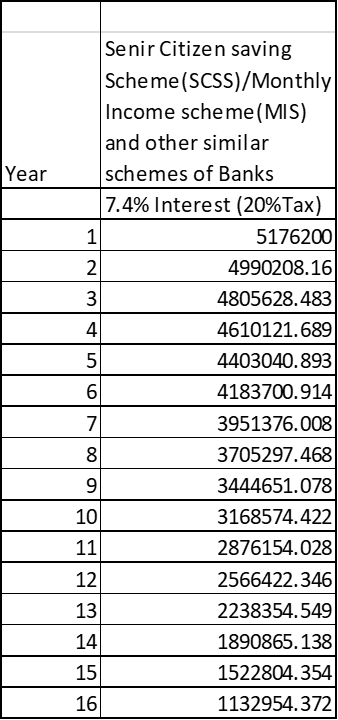

Senior Citizens saving Scheme or SCSS (Max limit Rs 1500000, 7.4% Interest rate as on 2022), post office monthly income scheme or MIS (Max limit Rs 900000, 6.6% interest rate). Banks rates could vary a little but for longer duration FD’s you get better ROI. For ease of calculation and comparison let us assume that all the schemes give a similar interest rate of 7.4%.

Now let us see if commuted amount is invested in Senior Citizen Scheme, Monthly Income Scheme or similar schemes of bank offering about 7.4% ROI then investment of commutation amount of Rs 51,76,200 gives an interest of Rs 31900 per month at ROI 7.4%. To make up the short fall of full pension(if not commuted) one needs to draw an amount of Rs 39783 per month(from table 1, refer row J). An additional amount of Rs 6340 per month needs to be withdrawn for payment of income tax on interest of Rs 31900 (at 20%). As the SCSS, MIS and similar schemes do not allow principal withdrawal in addition to interest, so it is assumed that the individual splits the investments in various short-term deposits of varying durations so as he can terminate them from time to time to make up the monthly short fall in pension.

This Below Table Depicts How Rs 5176200 Invested(Commuted Amount) Progresses After Withdrawing Rs 39783+ Rs 6340/Month From The Corpus To Make Up For Full Pension(7.4% ROI)

Table 2

In the table above one can see that even after 15 years when the pension is fully restored, there is still remainder of Rs 1132954 left. Thus even if one invests the commuted amount in senior citizen scheme, MIS and FD/Debt fund giving 7.4% then still you have 20% of corpus left after 15 years. If this amount is invested in a better manner in Debt MF and STP to equity MF or a hybrid MF then the remainder will be much more at the end.

So even if the commuted amount is invested in the above-mentioned schemes, still commutation is a better option.

Better way of investing lump sum commutation amount using Mutual Funds

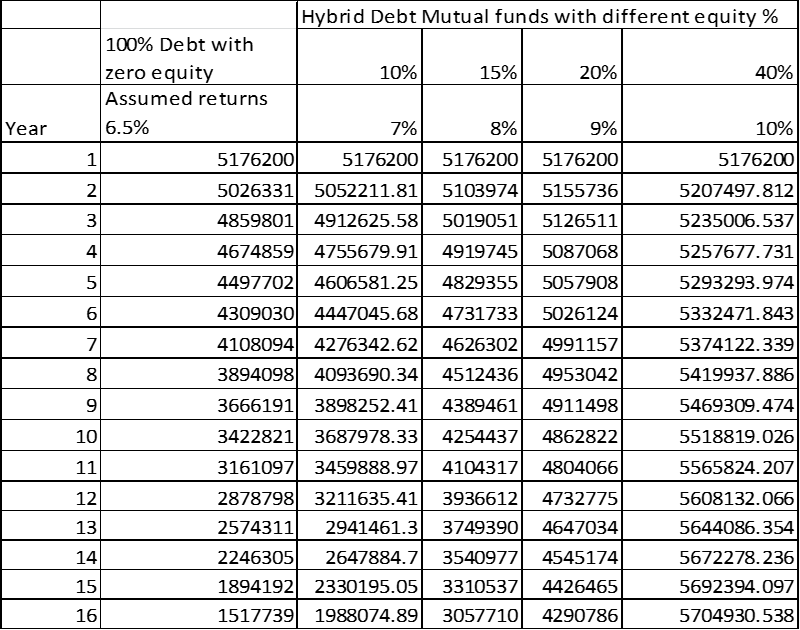

Now let us see if the commuted corpus is invested in MF and SWP ( systematic withdrawal plan) is done from corpus( to make up for full pension) then how the corpus progresses: –

The above table shows the balance amount of commutation of pension of Rs 51,76,200 after with drawl of Rs 40,783 per month (Refer table 1 row h to m. 39,783 to make up short fall in pension due to commutation, 1000 for capital gains tax liability on the amount with drawn). As shown the above table let’s say one invests Rs 5176200 in a debt MF that earns 6.5% returns and one withdraws Rs 40883 per month from the corpus then at the 16th year Rs 1517739 will still be left when the pension gets fully restored. So to say this way you get full pension as if you never commuted and at the end of 15 yrs, you still have about 15 lakhs left. If the amount is better invested in a hybrid MF having 40% equity content and giving 10% returns( which is highly possible with very minimal risk) then one could have about 57 lakhs left at the end of 15th year. The remaining corpus at different equity contents is depicted in row 16. The higher the equity content, the more the returns likely to be and larger the corpus at the end. From the above table at assumed returns of 9% for a hybrid MF with 20 % equity content, the corpus at end would be about 43 lakhs.

This way even after drawing SWP every month from the corpus the amount will still grow( 40% equity) and there is a possibility for the family to draw this amount throughout life.

Also, what needs to be understood is one may not need the full pension amount for monthly expenses, in this case one can withdraw only the amount they are falling short every month for expenses. The remainder amount stays invested and keeps growing and is available for use if need is felt anytime.

Understanding Tax efficiency in Mutual Funds compared to MIS, SCSS, Bank FDs

In mutual funds when one does SWP, the withdrawn amount comes in equal ratio from both principal and growth. For example, if one invests 1 lakh and does SWP of Rs 1000 per month then Rs 1000 will come into the account every month. Let’s say the MF was giving 6% per annum then it would have grown by about Rs 500 after a month so overall investment value will be Rs 100500. In the first month when one withdraws Rs 1000(SWP)which is about 1% of investment final value(Rs 100500), 1% of the withdrawn amount will be from the growth and 1% from principal. 1% of growth of Rs 500 is Rs 5. Remaining Rs 995 withdrawal will be from principal. So Rs 1000 withdrawn will be Rs 995 from principal and Rs 5 from growth. In debt MF for investment less than 3 yrs, it is short term capital gains and it get taxed at tax slab( gets added to income). After 3 yrs one gets indexation benefit(discussed later) and tax is likely to be about 10% only. Now when using SWP, only the growth gets taxed and not the principal. Here Rs 5 only get taxed at the slab rate of the individual. Considering 20% IT slab, the tax in first month will be Rs 1. With time as the growth amount becomes a larger portion of the total investment( larger amount will start coming from growth and the tax will increase to about Rs 40 by end of third year which is still less compared to other schemes discussed before). Thus, it can be seen that for an investment of Rs 100000 and monthly withdrawal of Rs 1000 (SWP) one pays a short-term capital gains tax of Rs 1 to Rs 40 for the first 3 years averaging Rs 20 per month.

After 3 years the tax liability on long term capital gains gets Nil or negligible due to indexation benefit. With assumed returns of 6.5% and average inflation rate of 6.6%, income tax liability almost becomes negligible. Considering lower inflation and higher returns, the tax is still likely to be about 10% which is still better than the avg 20% tax in FD’s, MIS, SCSS.

Indexation benefit in debt MF

After 3 years the realized capital gains in debt MF is treated as long term capital gains. One gets the benefit of Cost of Inflation Index( CII ) or commonly referred to as indexation benefit. Here the capital gains above the inflation rates only get taxed at 20% rate irrespective of one’s tax slab applicable. This amounts to approximately 10% tax in most of the times. Table 3 depicts historical CII and inflation. In table 3 with assumed returns of 6.5% and average inflation rate of 6.6%, income tax liability almost becomes negligible.

Table 3

Considering lower inflation and higher returns, the tax is still likely to be about 10% which is still better than the avg 20-30% tax in FD’s, MIS, SCSS(no such indexation benefit is available in these schemes)

In monthly income scheme/senior citizen saving schemes/FDs(most popular among veterans) for investment of 1 lakh one gets paid Rs 500 to Rs 600 per month (paid quarterly in SCSS) depending on the prevailing interest rates. The entire payment of Rs 500 to 600 is interest only, so it gets added to income for tax purposes. Assuming a tax rate of 20% one is liable to pay Rs 100 to Rs 120 tax on the withdrawn amount which is much more compared to avg 10% in MF. In 30% slab the tax in MIS, SCSS will be even more.

A few things you should know before you take the decision to commute or not

- Basic Pension is exactly half of your last drawn Basic Salary. And Basic Salary is Basic + Grade Pay + Rank Pay.

- Whenever commutation is done, only the Basic Pension gets commuted, never the DA received. Thus, after commutation also, the DA is received on full value of Basic Pension.

- As a ball park you get about a lakh per every Rs 1000 commuted.

- Since commutation is a one-time exercise, the reduction in pension due commuted amount per month remains static. So, while the pension rises continuously due to DA, pay commissions and now OROP, the commuted amount deduction remains same and continuously becomes a smaller proportion of the pension. When I retired in Aug 2011, my commuted amount was Rs 15,000 per month which was big proportion(30%) of my overall pension of Rs 30000+Rs 15000 DA. Now(2022) it is a very small proportion(appx 10%) of my Rs 89300+25000(DA) net pension.

- Commutation can be done of any value from 0% to 50%. However, generally almost all the officers get 50% commutation done, if they commute.

- Commutation is done based on a factor of commutation set by the Government which depends on the age on retirement. To put it more simply, it is the time adjusted Present Value of your future pension.

- Pension is fully restored (as if you never commuted) exactly 15 years after first commuted pension is received by you.

- Commutation can be done within one year of retirement, if one has not done commutation and wishes to change his decision, without any fresh medical examination. If one does it after one year from the date of retirement, one has to undergo fresh medical examination.

- If pensioner passes way his spouse will get full pension for next 7 yrs or 67 yrs of pensioners age(which ever earlier) even if commutation was done since the Govt disregards the commuted amount paid. Clearly, non-commutation in such cases is a big financial loss to the family. In this case the commuted amount just acts like a life insurance for the pensioner without actually having to pay anything for it. So, let’s say a pensioner commutes and passes away at age of 60, his spouse will get full pension as if commutation was never done for next 7 years and thereafter, they will get family pension(1/3rd basic salary).

- With Indian demographics the chances of a male person living beyond 70 years age is 50% only. For female it is 60%. Assuming a better income and living conditions for veterans in comparison to an average citizen the chances of living beyond 70 years may be little better say 50% to 60%. With commutation option one can make 100% chance of drawing 50% pension for at least 15 years for himself/family using methods enumerated in table 2 and 3. Then why opt for substantially lesser chance than 100% by not opting for commutation?

So why commute?

- The pension is fully taxable while the commuted amount is fully tax-free. If this commuted amount is properly invested, just a fraction of the tax would need to be paid compared to the tax on full un commuted pension.

- With proper investing and taking almost no risk or very low risk, one can draw an amount equal to commuted portion of pension as income every month while keeping a large commuted amount with you throughout your life. If commutation amount is wisely invested and SWP is done from it to make up for the reduced pension, even after 15 yrs when pension is restored fully, there is likely to be good corpus left (refer table 2 & 3)

- There would be a large bulk amount available in hand, which is a big asset to deal with emergencies, financial goals and responsibility or simply to lead a much better lifestyle.

Our Recommendations

We strongly recommend that all officers should commute their pension to the maximum allowed 50%. If the officers are also able to invest their commuted bulk amount wisely and carefully, there is not likely to be any difference in their take-home pension even after commutation while still having this large commuted amount with them. After 15 yrs when pension is fully restored there will still be a good corpus left over from the commuted amount that was invested. While there is safety and security in MIS and SCSS but after beating inflation the returns aren’t great and in any case it is not possible to invest the entire commuted amount in them. Debt MF and STP is recommended for investment of corpus as they are more tax efficient and have better returns than MIS, SCSS and FD’s.

By,

Sainik Wealth